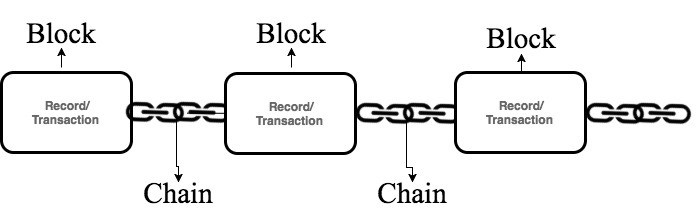

Distributed Ledger Technology, commonly referred to as “blockchain,” is a secure way for companies and individuals to share information without third-party oversight. Blockchain decentralizes electronic record-keeping, so users can easily share, add, and update information. Individual records or groups of records, the “blocks”, automatically link to previous records, the “chain”, to provide an electronic chain of custody.

While any number of users can add and share information, no user can unilaterally change previous blocks in the chain. Users can rely on the information in the blocks without a central authority administering the ledger. Blockchain reduces transaction costs and renders cumbersome and costly information sharing processes more efficiently and effectively.

See example below:

More complicated real-time applications of blockchain embed contract language into blocks. These “smart contracts” trigger automated responses, such as issuing payment when a specified event or set of events is met. The key to constructing these real-time applications is a dynamic and distributed architecture as the blockchain eco-systems are extremely complex.

For example, a blockchain-based property policy could include smart contract language that automatically alerts a regional claims office to dispatch case workers or drones to survey an area when the National Earthquake Information Center reports an earthquake of a certain magnitude. Another example is automated claims when certain catastrophic or weather events like hurricanes, tornadoes, forest fires, ect. occur in a given area.

“Blockchain is extremely real. It is probably the coolest thing to hit the security space, because we have this digital ledger now.”

– Tamara McCleary

Insurance being a data-intensive industry, adopting blockchain creates substantial advantages for insurance companies. As a result, insurers are aggressively exploring real-time applications based on this technology to harness the value of their data. Today, insurers are adopting blockchain applications in at least four areas: underwriting, claims management, fraud reduction, and reinsurance.

- Underwriting: Underwriting is the process of measuring a company’s risk and expressing it in currency. In order to accomplish this, insurers gather information and make predictions based on complicated risk models. But getting information from policyholders, cataloging the information into useful data, and drawing meaningful conclusions requires a significant investment of time, skills, and labor. Blockchain streamlines these functions.

- Claims Management: Insurance companies devote enormous resources to claims management. Managing the entire claims process, from receipt of the claim to final resolution, requires a substantial investment of resources. Blockchain streamlines the information-sharing process and can automate elements of the claims process, even in complex regulatory environments.

- Fraud Reduction: Blockchain applications reduce fraud in several ways. Specifically, they allow insurers to validate documents authenticity, including ownership records. They also enable insurers to verify identity and detect patters of fraudulent behavior.

- Reinsurance: Reinsurance allows insurers to lay off a portion of their risk to another insurance company in exchange for a premium. Reinsurance follows the fortunes of the primary insurance policy, so the reinsurer must reimburse the insurer for payments made to insureds. Blockchain allows information sharing in real time, so insurers and reinsurers can substantially reduce the transaction costs associated with placing and managing reinsurance contracts — and reduce the likelihood of unpaid claims due to failure to share information. Because reinsurers have very little recourse in determining whether a claim is paid, insurers owe a duty of utmost good faith.

These areas are historically high cost centers for insurers, so real-time blockchain applications represent the potential for substantial cost savings when implemented properly. Early insurance innovators and insuretechs alike are just starting to realize the wide range of possibilities for generating new revenue streams and cutting costs when utilizing new technologies such as AI, ML, and Blockchain.